Flexible financing for new, used, or refinanced vehicles- guided by people who put you first.

We make buying your next vehicle or refinancing your current one a simple and straightforward process. New or new-to-you, our Auto Loans are built to support your journey. Love your car but not your payment? Refinancing may lower your monthly payments.

Purchase new or pre-owned with loan options tailored to your budget and get into a car you love.

Refinancing your current loan could lower your interest rate, your monthly payment, or both!

From applying through closing, we’re here to help you through the process, making sure your loan aligns with your budget and goals.

Purchase new or pre-owned with loan options tailored to your budget and get into a car you love. Easily apply online for pre-approval so you will be ready to start the financing process when you find a vehicle that’s right for you. Additional finance options may include borrowing 100% (or more) of the vehicle’s J.D. Power® value! Look at dealers and inventory or get pre-approved now!

Effective 02/24/2026

| Term | APR As Low As1 | Monthly Payment Per $1,000 | Model Year |

|---|---|---|---|

| Up to 63 Months | 5.19% | $19.17 | 2026-2024 |

| 64-75 Months | 5.49% | $15.79 | 2026-2024 |

| 76-84 Months | 6.19% | $14.70 | 2026-2024 |

| 85-96 Months | 6.94% | $13.61 | 2026-2024 |

| Up to 63 Months | 5.44% | $18.29 | 2023-2019 |

| 64-75 Months | 5.94% | $16.00 | 2023-2019 |

| 76-84 Months | 6.49% | $14.85 | 2023-2019 |

| Up to 63 Months | 6.59% | $18.82 | 2018-2017 |

| Up to 48 Months | 9.59% | $25.17 | 2016-2015 |

| Up to 48 Months | 9.59% | $25.17 | 2014 |

1 All loans are subject to credit and collateral approval. The lowest advertised annual percentage rates (APRs) are available to well-qualified borrowers. Actual rates and amounts financed are determined by applicant’s credit score, loan term, and the age and mileage of the vehicle. Advertised APR for vehicle loans only. Rates and terms may change at any time without notice. APR is fixed and will not increase after consummation. Advertised APR includes a 0.30% loan discount (example 6.29% – 0.30% = 5.99%). A 0.10% discount will be applied to an eligible loan for each of the following qualifying three (3) factors: 1) Maintaining an open consumer checking account with a positive balance at least every thirty (30) days; 2) Maintaining an automatic payment established on the loan originating from a Lighthouse Credit Union account. Automatic payment must be established by contacting Lighthouse Credit Union; transfers set up in online or digital banking do not qualify; 3) Maintaining an active consumer credit card product. Active is defined as having transaction activity within the last ninety (90) days. If all qualifying factors are met, a total discount of up to 0.30% will be applied to the member’s base rate. Must request loan discount within ninety (90) days of the loan closing date. Discount conditions will be set forth in the Loan Discount Addendum. Must be a member of Lighthouse Credit Union with at least $5 in a Lighthouse Savings account. Auto loan payment example: a $15,000 auto loan with an annual percentage rate of 6.29% for a term of 63 months will have an estimated monthly payment of $307.05, including optional debt protection.

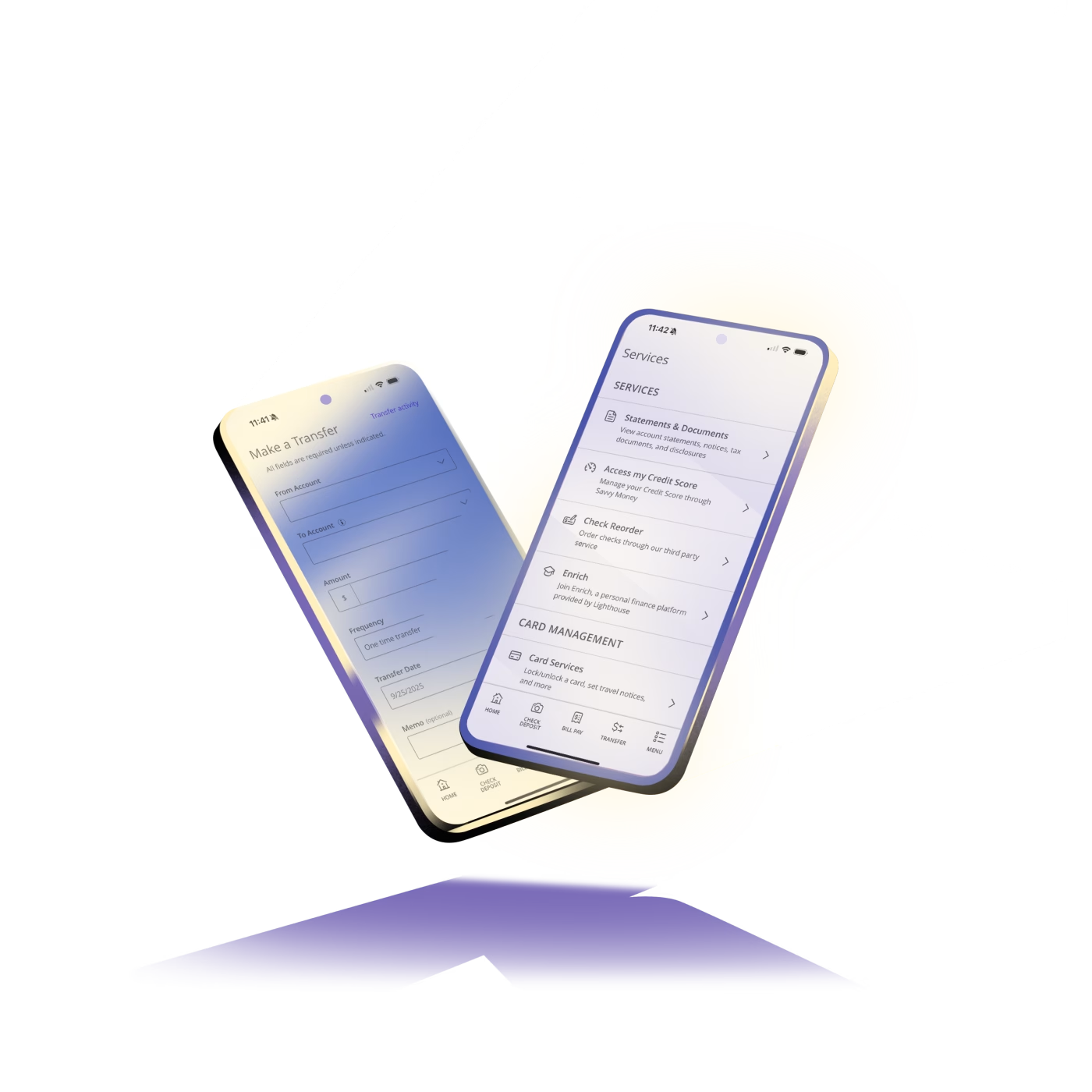

*Mobile check deposit is only available to members over 16 years old. Deposits are subject to our discretion. Standard Funds Availability policy applies. Please see the Mobile Deposit Disclosure and Agreement for details.

We provide financing options for new and used cars, trucks, and SUVs. Whether you’re buying your first car or upgrading your current one, we’ve got you covered. If you love your car but not your monthly payments, we may be able to help you save by refinancing your current loan.

Yes! In fact, refinancing may be a great option to alter your loan term, lower your monthly payments, reduce your interest rate, or maybe all three! If you’re approved, we’ll go through the options to help you get to where you want to be with your term and/or payments.

No, you can apply even if you’re not a Lighthouse member. If you’re approved and decide to move forward, we’ll help you establish your membership as part of the process. Learn more about becoming a Lighthouse Credit Union member.

You can apply online, by phone, or in person at any Lighthouse branch. Our lending team is here to answer your questions and help guide you through each step of the process.

Being a credit union member supports community impact by helping fund local programs through reinvested earnings.

We’re helping more people find homes and essential shelter through partnerships with nonprofits and local government.

Our employees are given paid time off to volunteer for community programs of their choice.

We partner with organizations that help to enrich and nourish the lives of our neighbors.

We fund programs that help fight food insecurity across our communities.